Spotting Fake Trading Gurus: Rented Lambos and Elusive Truths

Who to Learn From in a World of Lies

The years 2020-2021 were chaotic in the financial markets.

Easy money flooded the system, triggering a massive global speculation wave.

Traders flaunted returns of thousands of percent, and trading “gurus” sprouted like mushrooms after rain.

For naïve students of the market, the volatility meant a flood of success stories, many of which were unrelated to skill.

Traders appeared to be geniuses after one profitable year.

Over my many failed attempts in the financial markets, I’ve spent tens of thousands of $ on courses that turned out to be impractical at best or outright scams at worst.

I’ve prepared this brief guide to help you learn who you can trust—and more importantly, who you should avoid.

My First Trading Course

At 16, I looked forward with excitement to my weekly trip to the trading course I attended with my dad.

I’d skip the last class at school, jump into Dad’s car, and as soon as the door shut, we’d dive into stock talk.

What rose? What fell? Head-and-shoulders reversal patterns on the S&P 500 and bull flags on Apple.

We absorbed all the material we learned in our technical analysis course during our long drives.

As a kid from a tiny village on a northern hill in Israel, I was in awe of the campus where the course was held.

Tall, modern office buildings surrounded by rivers and fountains in the middle of the complex made everything feel glamorous and shiny.

I felt like I was finally stepping into a world where I could learn how money flows—and how to make some of it myself.

My dad and I would sit together in class, learning technical patterns and listening to heroic stories from the lecturer about his days in the markets.

On the drive home, we talked about nothing but stocks, full of enthusiasm, eagerly awaiting the next week.

Then, the College CEO Took His Own Life

We were blindsided.

The legendary CEO of the college—who was supposed to teach us how to crack the stock market—was found lifeless on campus.

It turned out he had suffered significant losses over the years and dragged down many students with him.

This was my first lesson: the CEO of a trading college didn’t make money trading. So, who can you really learn from?

You Are Their Trading Success

A few years after stepping away from trading, I was lured back by flashy online ads.

This time, it wasn’t a mediocre Israeli trading college. Enter Cameron Fous, a “super trader” flaunting a fleet of cars, a boat and a dream house—supposedly all funded by his trading profits.

He introduced me to Kunal Desai.

I enrolled in both of their courses and waved goodbye to over $10,000. I didn’t mind—I’d already chosen the color of my future Lamborghini.

But the profits never came.

I followed their instructions to the letter and, at best, broke even.

While they posted green screenshots daily, the patterns they taught just didn’t work for me.

Eventually, I realized their lavish lifestyles were bankrolled by students like me, not trading profits.

They never showed broker statements, and back then, platforms like Kinfo didn’t exist.

I swore I’d never pay another fake guru—unless it was for a Photoshop or marketing course, not trading.

Fintwit: the “Free” Education Era

There was a small-cap short seller who amassed tens of thousands of followers on Twitter.

Let’s call him Mr. Keyz. For a year, he posted daily profits of tens of thousands of dollars from shorting stocks.

He shared his thought process—but only after the trades were completed, with post-facto reasoning and results.

Despite the lack of transparency, it seemed authentic.

I watched him recap his trades on Instagram every day, thinking I was learning.

In retrospect, though, it was mostly entertainment—replacing Netflix with something else.

At some point, Mr. Keyz teamed up with another influencer—let’s call him Lambo Larry.

Lambo Larry was a trader considered a legend for making millions in OTC stocks.

He frequently posed with his Lamborghini and posted daily recaps from his stunning home.

When they launched a paid service, it was a no-brainer for many in the Twitter trading community.

Although I never subscribed, I spent hours trying to learn from them.

I watched their daily livestreams, read all their trade summaries, and backtested their strategies.

But something didn’t add up.

While they posted consistent profits, there were also massive losing trades—yet they always seemed to dodge them.

Eventually, the cracks started to show.

“Mom, Where Are Dad’s Car Keys?”

Mr. Keyz portrayed himself as a family man—a 23-year-old trading prodigy still living at home despite his millions.

One of his Instagram livestreams featured his prized Mercedes, which he claimed was bought with trading profits.

When a viewer asked him to start the car so they could hear the engine, Mr. Keyz left his AirPods in the driveway and went upstairs.

Moments later, he was heard asking his mom for his dad’s car keys.

It turned out the Mercedes actually belonged to his wealthy father.

Lambo Larry’s story unraveled as well—his Lamborghini and mansion were, in fact, owned by his sister, a famous singer from abroad.

And there are many other creative ways to appear as a trading guru, beyond just showing off cars.

997 Ways to Deceive You

Fake gurus have countless ways of making us believe they’re legitimate.

Photoshop helps them show off massive profits every day.

Red arrows can appear at the exact top, and green ones at the exact bottom (Hi Morg🫠).

The money they make from marketing is funneled into buying a nice car, presented as proof of trading success.

It’s easy to alter values on web platforms like Interactive Brokers or any other broker.

You can even change values on desktop trading platforms with the right software.

Altering profits doesn’t even require a sophisticated hacker—some offshore brokers allow their affiliates to put fake profits into their accounts (saw it with my own eyes).

As a beginner trader, it’s incredibly difficult—if not impossible—to find profitable strategies on your own.

So, in a sea full of sharks lurking for your money, who can you trust?

Who should you learn from?

Luckily, today there are many legitimate options.

Legit Options to Learn From

Books

Many successful traders have written books sharing their methods.The Market Wizards series is filled with stories of traders who provided verified broker statements.

Examples include Jason Shapiro and Linda Raschke, who also teach their strategies.

I will also recommend here “How to Make Money Stocks” by William J. O’neil and “Insiders Buy Superstocks” by Jesse C.Stine.

I was able to backtest part of their strategies and found gold.

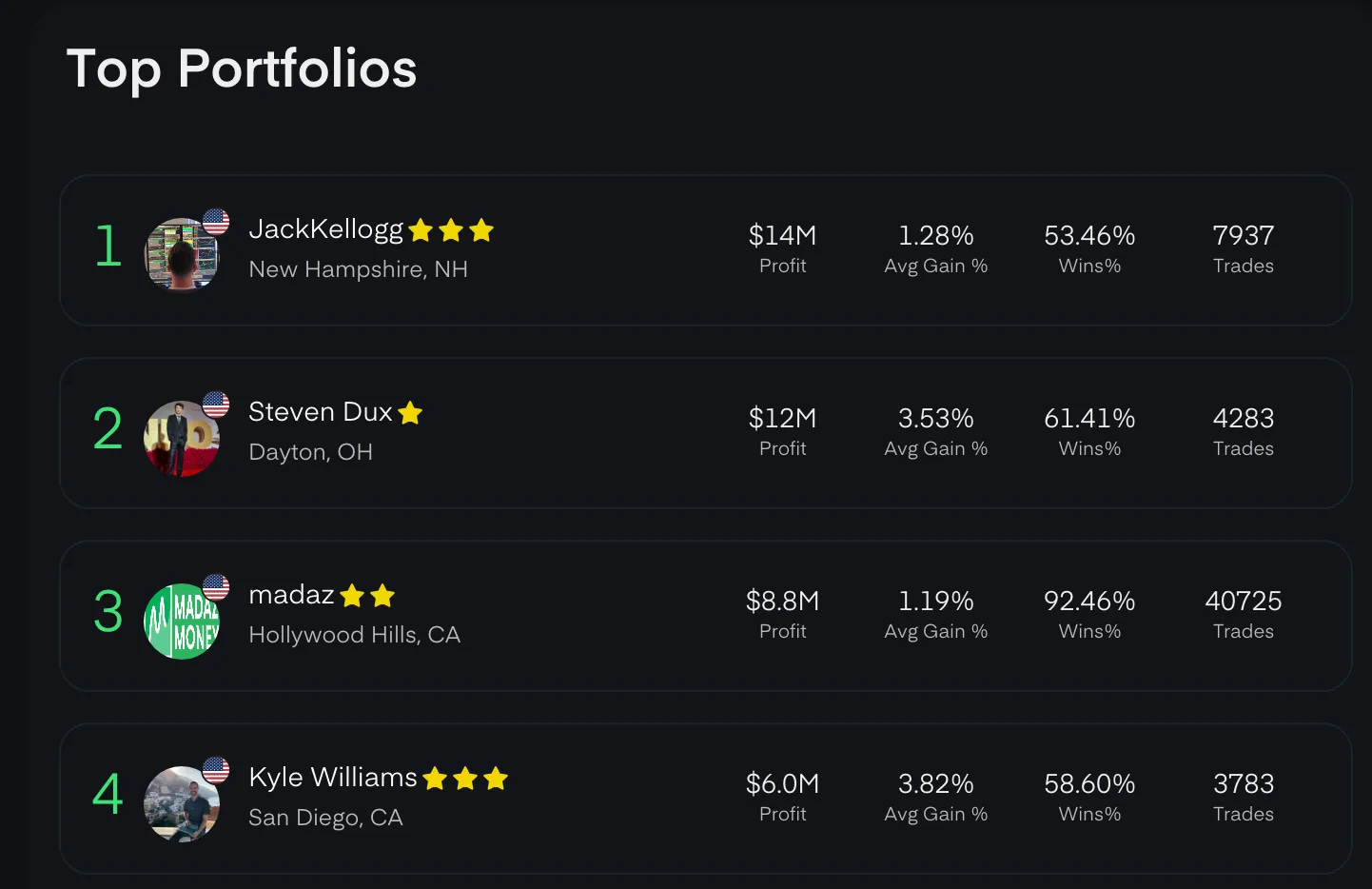

kinfo.com

This site connects directly to brokers to display verified trading results.Check the leaderboard for profitable traders and learn from their trades.

Hedge Fund Performance Tables

Do some detective work.Research top-performing managers, read interviews, and study their strategies.

US Investing Championship Winners

This competition verifies traders’ legitimacy.For instance, Marios Stamatoudis, whom I met in Athens, shares his strategies for free.

Backtesting

Listen to podcasts like Chat With Traders or read old books on trading strategies. The cool thing about old strategies shared by traders is that you now have a ton of out-of-sample trades to test on—and see if the performance remains consistent.If you don’t know how to code, you can test them on platforms like Spikeet, where you can export all the data to Excel and run your analysis.

Don’t let fake gurus waste your money—or your time like I did. Use it to develop your own strategies instead.

I also wonder why a trader who is profitable and makes thousands on daily basis will ever do courses?

Hey Niv, did you by any chance ever come across Adam Khoo and if yes, what are your thoughts on his trading strategies, do you think it is one the legit ones? Not at all asking, cause i spent 2k for swing trading courses there and now trying to reason with myself, if it is actually legit or if i have been fooled haha